Theo Von is an American stand-up comedian, actor, and television host with a net worth of $5 million. He rose to fame at 19 as a cast member of MTV’s “Road Rules: Maximum Velocity Tour” and later appeared on various “Real World/Road Rules Challenge” seasons.

In 2006, he competed on NBC’s “Last Comic Standing.” Von has released Netflix specials, including “No Offense” (2016) and “Regular People” (2021), as well as the comedy album “30lb Bag of Hamster Bones” (2017).

He has guest-starred on shows like “Inside Amy Schumer” and “Why? with Hannibal Buress,” and appeared in films such as “Bobby Khan’s Ticket to Hollywood” and “InAPPropriate Comedy.”

Theo Von (Credit: YouTube)

Theo Von hosted the TV series “Primetime in No Time” (2012–2014) and “Deal With It” (2013–2014).

He is also known for his podcasting work, hosting “The Comedy Sideshow” (2011), “Allegedly with Theo Von & Matthew Cole Weiss” (2015–2018), “This Past Weekend” (2016–present), and “King and The Sting (and Wing)” (2018–2022).

Real Estate Properties

In March 2021, Theo Von purchased a 4,918 square foot home in Nashville, Tennessee, for $1.645 million from former Vanderbilt head coach Derek Mason, who had bought it for $1.095 million in 2014. Additionally, Von owns an apartment in Los Angeles, California.

Andrew Carnegie was a Scottish-American industrialist who significantly transformed the American steel industry in the late 19th century. At his peak, his inflation-adjusted net worth reached approximately $310 billion, ranking him as the fourth richest person in history.

Renowned for his philanthropy, Carnegie donated over 90% of his fortune to foundations, charities, and educational institutions, leaving a lasting impact on society before his death.

Andrew Carnegie expanded the American steel industry in the 19th century by pioneering mass production techniques and implementing vertical integration in steel production.

At his peak, he controlled the largest integrated iron and steel operations ever owned by an individual in the U.S.

One of his key innovations was the adoption and adaptation of the Bessemer process, which allowed for the cheap and efficient mass production of steel, revolutionizing the industry and contributing to America’s industrial growth.

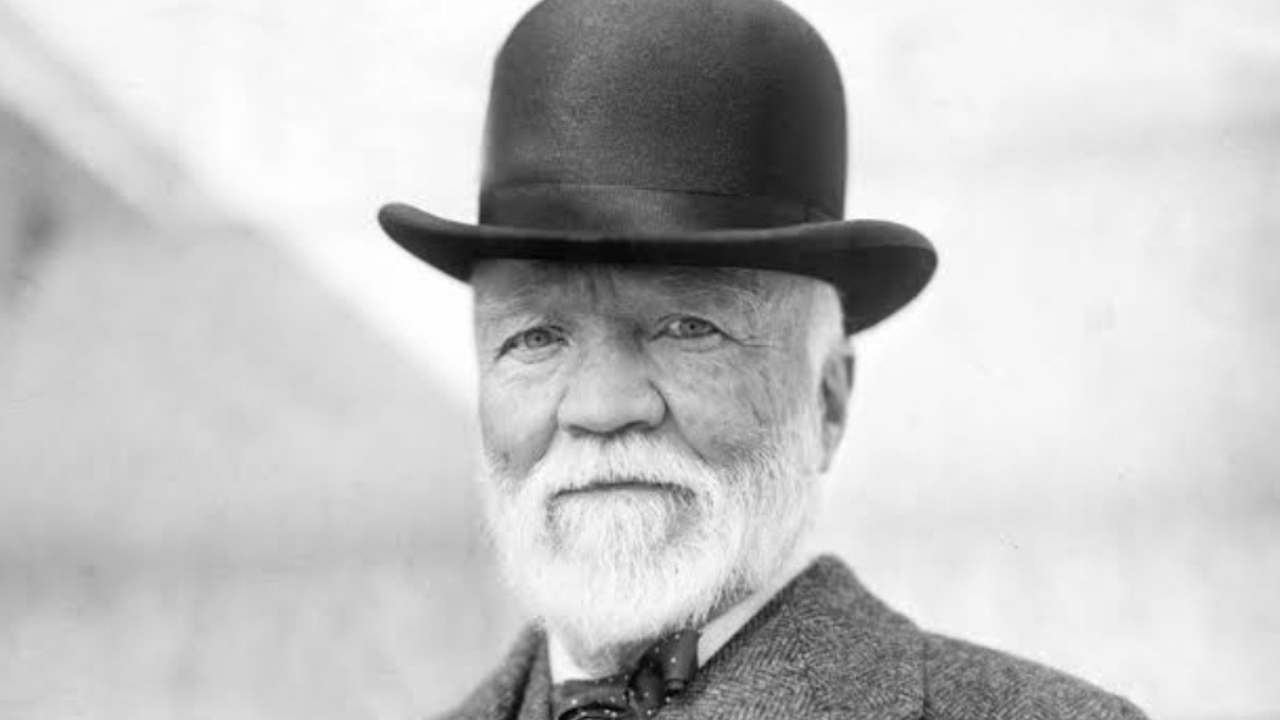

Andrew Carnegie (Credit: Pinterest)

In 1909, Andrew Carnegie sold his company, Carnegie Steel, to J.P. Morgan for $303 million, with Carnegie’s share amounting to $225 million—equivalent to about $7 billion today.

The total value of the sale increased to $480 million due to interest on the bonds used for the transaction.

Compared to the U.S. GDP at that time, Carnegie’s wealth translates to hundreds of billions today, with estimates of his current equivalent net worth ranging from $300 billion to $310 billion.

The U.S. Steel Corporation, formed after Carnegie sold his company, became the first U.S. company to reach a market capitalization of over $1 billion.

Following the sale, Carnegie dedicated the rest of his life to philanthropy, focusing on local libraries, world peace, education, and scientific research.

By the time of his death, he had donated over $350 million of his fortune, and his remaining $30 million was allocated to various foundations, charities, and pensions for workers.

As Andrew Carnegie approached retirement in the early 1900s, Charles M. Schwab, a Carnegie Steel executive, began secretly negotiating to sell the company to financier J.P. Morgan.

Schwab is not related to the contemporary Charles Schwab financier, but J.P. Morgan’s banking institution is indeed a direct descendant of the same financier, establishing a significant legacy in American finance.

The deal for Carnegie Steel was finalized at $303 million, with Carnegie receiving over $225 million. The newly formed United States Steel Corporation was managed by Schwab. Since J.P. Morgan lacked the cash for the payment, he used bonds instead, which offered 5% annual interest over 50 years.

These bonds were stored in a specially built vault at a bank in Hoboken, New Jersey. Over time, the total cost of the acquisition, including interest, grew to $480 million.

One of Andrew Carnegie’s first actions after selling Carnegie Steel was to transfer $5 million to fully fund a pension for his steel workers, demonstrating his commitment to their financial security and well-being.